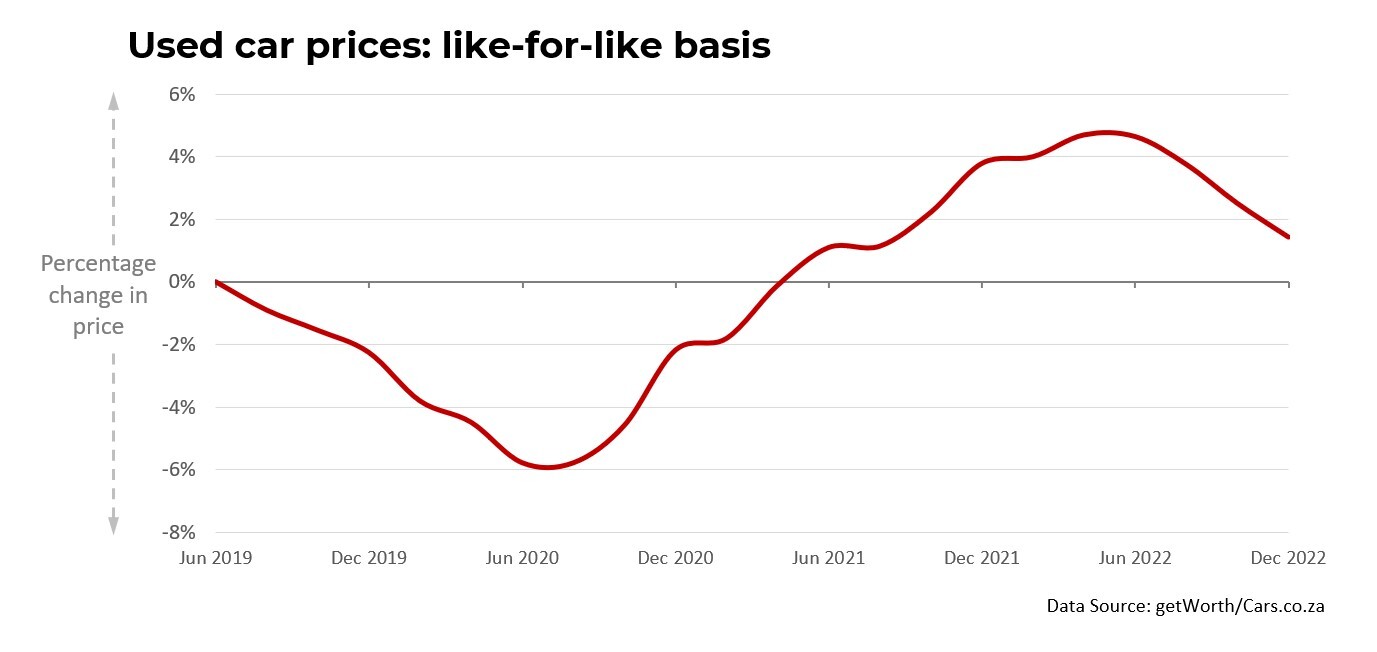

Your car might be underinsured, according to a recent study by car pricing experts at getWorth. The company’s data analysts have compared actual used car market prices with insured values and found that insurance values have not kept up with the fast-changing market since the start of the Covid pandemic.

As a result, car owners who experience a total loss could receive an insurance payout that falls short of the replacement cost for a similar vehicle, potentially by hundreds of thousands of Rands.

Chief Technical Officer of getWorth, Mark Ridgway, explains that insurance companies typically use the “book value” to determine a payout amount in the event of a total loss. However, book values are based on long-term trends, and the used car market has been impacted by the pandemic, causing prices to increase, which are now out of sync with book values.

Ridgway points out that discrepancies in insurance values are not uniform, with some models being more severely underinsured than others, such as a Toyota Land Cruiser 200 which could be underinsured by 15% to 30%. Additionally, mileage also affects the market value of a car, with low-mileage vehicles having a higher value.

Car owners can protect themselves by requesting their insurance company or broker to provide the insured value for a total loss. If the value is not in line with current market prices, car owners should ask their insurer if they can adjust the insured value.

It’s important to note that these differences only affect incidents resulting in a total loss, such as theft or write-off. For minor damages, such as a damaged windscreen or a fender-bender, the insurer will pay for repairs, regardless of the market value of the car.